Ashraf Engineer

June 17, 2023

EPISODE TRANSCRIPT

Hello and welcome to All Indians Matter. I am Ashraf Engineer.

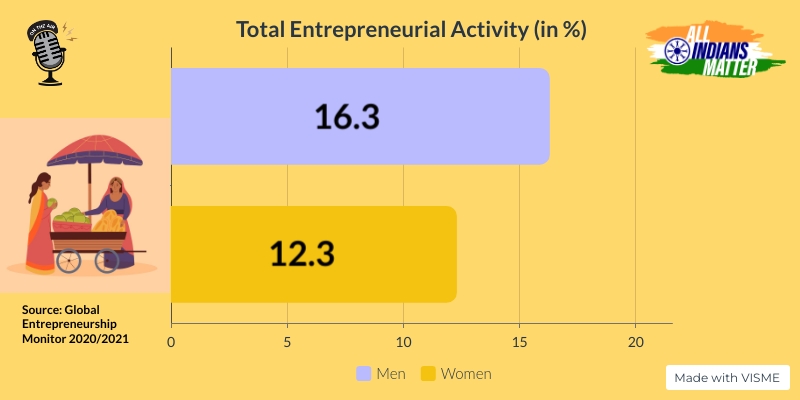

There’s been a great celebration of entrepreneurship in India, especially of startups, and it’s been an area of focus for policymakers too. Indian entrepreneurs generate employment and keep the economy humming and they’ve shown great innovation and resilience over the decades. What I want to focus on in this episode are the challenges before India’s women entrepreneurs and what can be done to overcome them. According to the Global Entrepreneurship Monitor 2020/2021 report, total entrepreneurial activity – or TEA – in India is at 14.4%. The TEA for men is at 16.3% while that for women is at 12.3%. The report said that women in India have start-up intentions at parity with men and close to the global average but, when it comes to gender equity in entrepreneurship, India has a long way to go.

SIGNATURE TUNE

Being a woman in India is difficult and it’s even tougher to be a woman entrepreneur. Most women have no assets to their name to offer as collateral. There are other barriers, like complicated documentation requirements – often linked to male family members.

While the number of women-led micro, small and medium-sized enterprises jumped from 2.15 lakh to 1.23 crore in a decade, they account for only 20% of India’s 63 million MSMEs. As per Ministry of Micro, Small and Medium Enterprises data, men own 79.63% of businesses as compared to 20.37% owned by women.

However, no one should underestimate the contribution of women entrepreneurs to our economy. They account for 3.09% of industrial output and employ 10% of total workers, according to ifc.org. Yet, India ranks third-highest in the entrepreneurship gender gap – only 33% of early-stage entrepreneurs are women.

The Mastercard Index of Women Entrepreneurs 2021, meanwhile, ranked India 57th out of 65 countries. The report pointed to cultural conditions and bias that prevent or discourage women from becoming entrepreneurs. It added that women are also reluctant to grow their businesses due to lack of funding.

So, India needs to facilitate better access to finance for its women entrepreneurs. It also needs to make it easier to do business through single-window clearances, tax cuts and other measures.

A report by Bain and Company in 2019 said: “When provided with equal access to inputs, women-owned enterprises produce equally strong economic outcomes when compared with enterprises led by men.”

Is there a quantification of the potential? Yes! According to McKinsey Global, India could add $700 billion to its GDP by increasing women’s participation in the labour force. The Boston Consulting Group, meanwhile, suggested that startups with women founders or co-founders generate 10% more revenue over a five-year period, and employ three times more women than men.

Why do women make such good entrepreneurs? There are several reasons but, for one, they seem to make businesses work as well with lesser investment compared to men. For another, they are great at multitasking. According to a University of Hertfordshire study, when women and men were assigned two tasks at once, women slowed by 61% while men slowed by 77%.

Women’s risk appetite seems to be higher too. A KPMG survey showed 43% of women are more willing to take more risks.

At the MSME level, India already has self-help groups, or SHGs, that enable economic empowerment of women and nudge social change along. Such a group comprises 12 to 25 women from a locality between the ages of 18 and 50. They make small but regular savings contributions until there is a substantial amount to begin lending to the community. Many groups are linked with banks too to enable microfinance delivery.

But SHGs go beyond finance; they act as forums for women to come together and exchange notes on their businesses as well as health, nutrition and social issues. So, they are a community in themselves.

Through the National Rural Livelihood Mission, the government has given SHGs a capitalisation of Rs 10,200 crore and they have also earned bank credit of Rs 2.9 lakh crore. So effective are the groups that they have very low non-performing asset ratios, which is a huge plus when it comes to seeking further finance. The National Bank for Agriculture and Rural Development, or Nabard, estimates that as of March 2020, the total NPA rate for women-led SHGs was 4.9%. This was less than half the rate for NPAs in banks.

Despite these bright spots, entrepreneurship for women in India has been an uphill climb. Let’s take a look at some of the common challenges.

First, funding. It’s the lifeblood of business but women entrepreneurs find it challenging to secure. This is mainly because they have few assets in their name to pledge as collateral. There are other criteria lenders insist on, such as the business being at least two to three years old, proper documentation and a high credit score. This forces women entrepreneurs to depend on savings or loans from family and friends.

Second, lack of professional support networks. Many small businesses fail because they don’t have access to network development. Networking helps to scale ventures and reach new markets. Women entrepreneurs in India are less likely to be integrated with formal and informal networks.

Third, gender barriers in certain industries. Many sectors, such as manufacturing, are dominated by men. Women business owners struggle to break into these sectors for various reasons, such as lack of knowledge of industry processes or contacts.

Fourth, societal pressure to stick to traditional gender roles. We live in a patriarchal society that has defined gender roles. Women are told from the start that their job is to take care of the family and household chores. If there are professional commitments, they come second. This results in a tremendously challenging environment that many simply can’t overcome.

That brings us back to governmental support. The most popular scheme among women-led MSMEs is the Micro Units Development and Refinance Agency, or MUDRA. The scheme itself is gender-agnostic but it’s particularly suited to women because it offers collateral-free loans, removing a huge financing barrier.

There are other women-centric schemes, such as the Prime Minister’s Employment Generation Program, Stand-Up India, Mahila UDYAM Nidhi scheme, Udyogini scheme, SIDBI Make in India Loan for Enterprises and also the Rural Self-Employment Training Institutes.

However, lack of awareness about them is a major obstacle. Those who know of the schemes are often unaware of their specific features. This means there is a low uptake and many banks have discontinued them. So, it’s the implementation that drains away the efficiency of these programmes.

As I’ve pointed out earlier, women entrepreneurs deliver results and it’s in the interest of the overall economy to ensure they get the best support possible – whether it’s in the form of training or hassle-free finance. We have the programmes and willing beneficiaries. It’s a question of ironing out the creases.

Thank you all for listening. Please visit allindiansmatter.in for more columns and audio podcasts. You can follow me on Twitter at @AshrafEngineer and @AllIndiansCount. Search for the All Indians Matter page on Facebook. On Instagram, the handle is @AllIndiansMatter. Email me at editor@allindiansmatter.in. Catch you again soon.